Most important Heading Subtopics

H1: Transferable Letter of Credit: How you can Construction Risk-free Multi-Provider Discounts Applying MT700 -

H2: Exactly what is a Transferable Letter of Credit rating? - Basic Definition

- Purpose in Intercontinental Trade

- Difference from Again-to-Back again LC

H2: Who Can Use a Transferable LC? - Exporters

- Investing Businesses (Intermediaries)

- 1st and Next Beneficiaries

H2: Knowledge MT700 in Transferable LCs - MT700 SWIFT Information Overview

- Industry 40A and Transferability Guidance

- Related Clauses and Modifications

H2: When Must you Make use of a Transferable LC? - Elaborate Offer Chains

- Multi-Supplier Orders

- Deal Fulfillment Across Nations around the world

H2: Move-by-Stage Breakdown of a Transferable LC Transaction - Issuance by Consumer’s Bank

- Transfer to Secondary Suppliers

- Doc Managing and Payment Movement

H2: Great things about Employing a Transferable LC for Intermediaries - Chance Mitigation

- Enhanced Working Cash Administration

- Enhanced Negotiating Position

H2: Rights and Limits of the 1st Beneficiary - Rights to Transfer

- Legal rights to Substitute Files

- Limits and Limitations

H2: Essential Differences: Transferable LC vs Back again-to-Back again LC - Transaction Mechanics

- Bank Involvement

- Pitfalls and value Implications

H2: The best way to Framework a Transferable LC Safely - Picking out the Ideal Lender

- Drafting Distinct Recommendations

- Running Timing and Documentation

H2: Typical Faults in Transferable LC Transactions - Failing to Explain Transfer Situations

- Mismatched Files

- Confusion Among Beneficiaries

H2: Essential Fields within the MT700 for Transferable LCs - Subject 40A (Sort of LC)

- Industry 46A (Documents Necessary)

- Field 47A (Extra Circumstances)

H2: Purpose of Advising and Transferring Financial institutions - Their Obligations

- How Transfers Are Executed

- Handling Doc Substitution

H2: Legal and Compliance Concerns - UCP 600 Principles on Transferability

- ICC Recommendations

- Contractual Hazard Management

H2: Scenario Research: Transferable LC inside a Multi-Provider Offer - How a Trading Organization Structured the LC

- Difficulties and Alternatives

- Key Takeaways

H2: Electronic Improvements in Transferable LCs - eUCP and Electronic Transfers

- SWIFT Enhancements

- Blockchain and LC Automation

H2: Regularly Requested Concerns (FAQs) - Can any LC be transferred?

- Can a transferable LC be confirmed?

- How over and over can or not it's transferred?

- What’s the expense to transfer?

- Who substitutes the Bill?

- Can the second beneficiary transfer it once again?

H2: Summary - Summary of Very best Techniques

- Ultimate Tricks for Secure LC Structuring

Up coming, I’ll get started composing the completely comprehensive, long-variety write-up making use of this outline.

Transferable Letter of Credit history: How to Structure Harmless Multi-Provider Deals Working with MT700

What on earth is a Transferable Letter of Credit history?

A Transferable Letter of Credit is a robust economical instrument in world-wide trade, particularly when transactions require many suppliers or intermediaries. It enables the 1st beneficiary (ordinarily a buying and selling business or agent) to transfer all or Portion of the credit to a number of 2nd beneficiaries (commonly true suppliers or companies).

This adaptability is vital in multi-provider bargains where by an individual consumer deals indirectly with many producers. Unlike a Back-to-Back again LC, where two independent credits are issued, a Transferable LC works beneath a single credit rating that may be shared—rendering it easier and sometimes more Charge-powerful.

Who will Make use of a Transferable LC?

Transferable LCs are commonly employed by:

Investing Organizations: Who get from a number of suppliers and sell less than an individual buyer agreement.

Export Brokers and Intermediaries: read more Who don’t make items but coordinate provide.

Large Exporters: Taking care of subcontractors across areas or countries.

This tool is especially helpful in industries like textiles, electronics, and agriculture, in which elements or products and solutions originate from numerous suppliers.

Being familiar with MT700 in Transferable LCs

The MT700 could be the normal SWIFT concept utilized to difficulty a documentary credit history. When structuring a Transferable LC, distinct fields during the MT700 turn out to be critically important:

Industry 40A – Ought to condition “Transferable†to get qualified for partial or whole transfers.

Subject 46A – Lists the files that both equally the primary and second beneficiaries need to offer.

Industry 47A – Includes added problems, like irrespective of whether invoices may be substituted or partial shipments authorized.

These fields give composition and clarity to how the transfer is executed and make sure the rights and duties of each occasion are very well-documented.

When Must you Use a Transferable LC?

A Transferable LC is ideal for predicaments like:

Elaborate Offer Chains: When sourcing merchandise from various suppliers beneath one particular agreement.

Subcontracted Production: Wherever various sellers lead components for a remaining product.

Middleman Gross sales: When the main beneficiary acts as being a facilitator or broker.

In these conditions, only one LC is usually split, allowing each 2nd beneficiary to get their percentage of payment when they supply products and submit the needed documents.

Stage-by-Action Breakdown of the Transferable LC Transaction

Buyer Problems LC: The customer instructs their bank to concern a transferable LC by using MT700.

LC Acquired by To start with Beneficiary: Typically an intermediary or trading household.

Transfer to 2nd Beneficiary: The LC is partially or thoroughly transferred to suppliers.

Cargo and Documentation: Each individual provider ships goods and submits files According to the LC.

Doc Verification: Transferring financial institution verifies documents.

Payment Produced: On compliance, payment is designed to suppliers and any margin to the main beneficiary.

Robert Downey Jr. Then & Now!

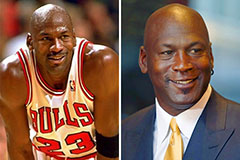

Robert Downey Jr. Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!